Why Liquidity is important

Here is a detailed explanation Why Liquidity is important in stock market and pending liquidity

Understanding Liquidity

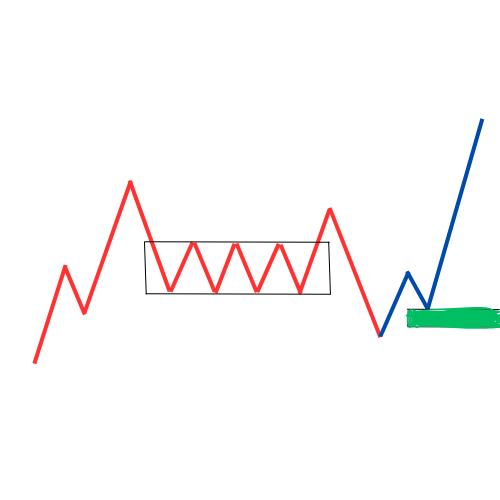

In the simplest terms, liquidity is where traders and investors place their stop-loss (SL) orders. The market moves up and down because there are buyers and sellers. With every rise and fall, there are support and resistance levels. These are the points where stop-loss orders are concentrated. The market’s price will not form a new range until these stop-loss levels are triggered. The provided text emphasizes that liquidity is a crucial concept for traders to understand because it’s where significant market moves originate.

What is Pending Liquidity?

Pending liquidity refers to the stop-loss orders that have been placed in the market but have not yet been cleared or triggered. The text explains that the market may give a one-sided movement for a long time, not hitting the stop-loss orders of a large number of traders. These untriggered stop-loss orders create a pool of pending liquidity.

The market needs to clear this pending liquidity to generate profits and continue its movement. According to the text, a sudden news event, such as an economic announcement or a geopolitical event, can trigger these stop-loss orders, leading to a sharp market movement. The text warns against entering trades on small movements, and instead, suggests waiting for the market to clear out the pending liquidity first.

This concept is related to the Accumulation, Manipulation, and Distribution cycle. The text explains that large players (big whales) manipulate the market to trigger the stop-loss orders of smaller traders and collect their money. Understanding pending liquidity helps traders track the “footprints” of these large players to minimize their own losses.

suggest you to read Road map to start Trading and Investing

Why Is Liquidity Important?

The text stresses that understanding liquidity is not a stand-alone solution for success in trading. It is one of several critical concepts that traders must master. A comprehensive approach to trading involves a combination of the following:

Technical Analysis:

This includes understanding candlesticks, chart patterns, and support and resistance levels.

Volatility:

Knowing what causes market volatility, such as news, inflation reports, company updates, and policy changes by central banks (like the RBI).

Market Sentiments:

Assessing whether the overall market sentiment is bullish (upward trend), bearish (downward trend), or sideways.

News & Events:

Staying updated on news and events is vital for day traders, as positive news can lead to significant profits.

Trading Plan:

Having a clear plan is essential for survival. This includes a strategy for when and where to enter a trade and, most importantly, a solid exit plan. The text highlights that knowing when to exit, even at a loss, is crucial to avoid getting trapped in a losing trade.

Psychology:

Emotional control is paramount. The text warns against revenge trading after a loss, which often leads to taking on more risk and making bad decisions.

Risk Management:

This is critical for protecting capital. The text suggests risking no more than 1% to 2% of your total capital on a single trade. For example, on a ₹50,000 capital, the maximum loss should be limited to ₹500 to ₹1000. This disciplined approach ensures long-term survival in the market. A good risk-to-reward ratio of 1:2 to 1:3 is recommended, but the text also advises exiting a trade if profits start to diminish, even if the target is not reached.