Yesterday’s Performance (Pichle Din Ka Pradarshan)

The market has been on an upward trend for a few days, exhibiting bullish sentiments, with some profit booking observed.

Asian Market (Asian Market)

This morning, October 16, 2025, the Asian market showed strength with gains in Nikkei and Hang Seng. Overall, a bullish trend was seen across all major Asian indices today.

Gift Nifty

Gift Nifty is also showing bullish sentiment.

US Market (US Market)

The market opened with strength and closed higher.

Nifty 50 Sentiments Wednesday 16/10/2025 (Outlook)

Nifty opened this morning with a significant gap-up, crossing the level of 25,400 to 25,450. There was a substantial number of sellers’ stop-losses (SL) around 25,450. After a slight dip, the market closed above 25,550, touching the 25,600 level. For the past two days, profit booking has been seen in the market amidst buying.

Key Levels

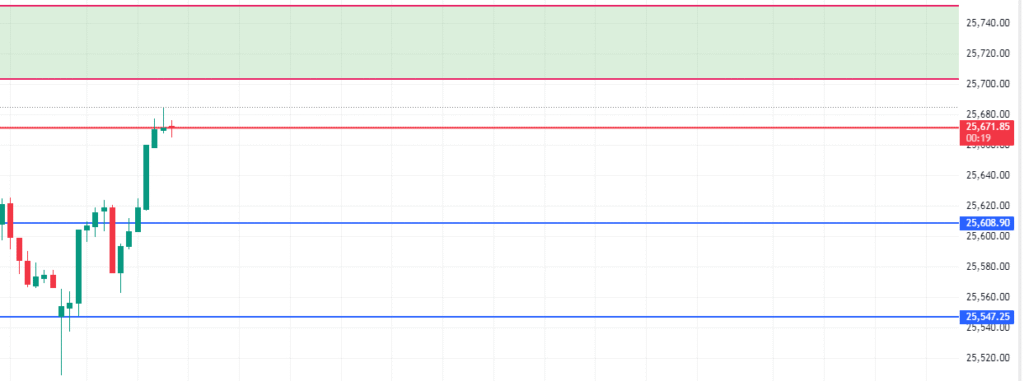

Selling pressure is being observed in Nifty. If the market falls below 25,550 and retests that level, we could see a downside target of 25,500 to 25,450. However, this is described as a market trap, as buyers are currently more dominant than sellers. Furthermore, buyers have maintained control over 50% of the selling pressure seen on September 24th.

Alternatively, if the market stays above 25,550 and retests it, the next resistance could be from 25,600 to 25,650. Since sellers are still positioned at higher levels, we should not take a downside entry until the market takes out their Stop-Losses (SL). If the market opens gap-up and remains above 25,600, it is a positive sign, but we should only enter after a retest. In this scenario, our targets would be 25,650, 25,700, and up to 25,750.

proof

achieving target

Disclaimer

This information is for educational purposes only and should not be considered financial advice. Please consult with your financial advisor before making any investment decision.