Nifty 50 Analysis monday 15/09/2025

Previous Day’s Performance

For the past few days, the market has been bullish. There was some profit booking, although the market gained more momentum after a tweet (X post) by Donald Trump.

Asian Market

This morning, September 12, 2025, the Asian markets saw an upward trend, with both the Nikkei and the Hang Seng trading positively. Gift Nifty also showed a bullish sentiment.

US Market

The market started strong and closed on a positive note.

Nifty 50 Sentiments for Monday, September 15, 2025 (Outlook)

Support Levels

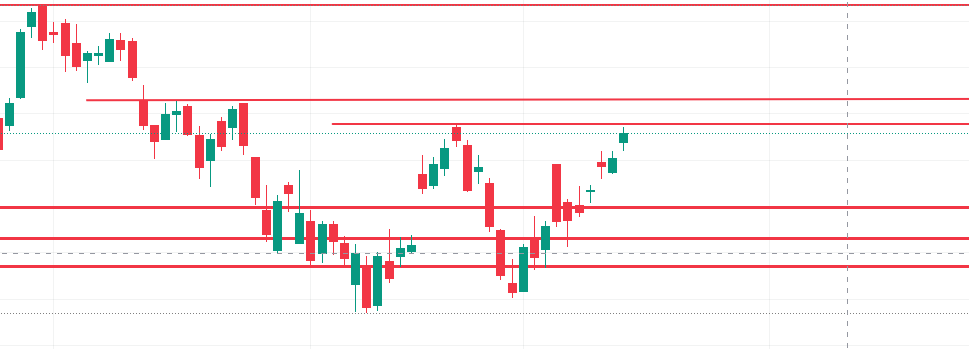

Based on the daily candle chart, a double bottom has formed, indicating good support. We have two key support levels:

- The first is a strong support at 24,360.

- The second is a strong support at 21,800. If this level is hit, the market could move even lower.

As you can see on the daily candle chart.

Resistance Levels

There are two resistance levels to watch

- A strong resistance level at 26,270.

- Another strong level at 25,670.

If the market breaks the 26,270 level, a new resistance level will form.

Overall Sentiment

The overall market sentiment is on the bearish side. This is because there is a strong resistance level at 25,050 on the 15-minute chart. The market has been on a one-sided rally for the past few days, and all the buyers who entered at lower levels still have their positions open. As long as their stop-loss isn’t hit, the market won’t reach the resistance level.

Therefore, it is not advisable to plan a buy-side trade until the stop-loss levels below are hit. If the market does hit the resistance levels mentioned above, you should wait and observe.

Disclaimer

This information is for educational purposes only and should not be considered financial advice. Always consult with your financial advisor before making any investment.

sativa edibles online designed for energy and productivity

okay